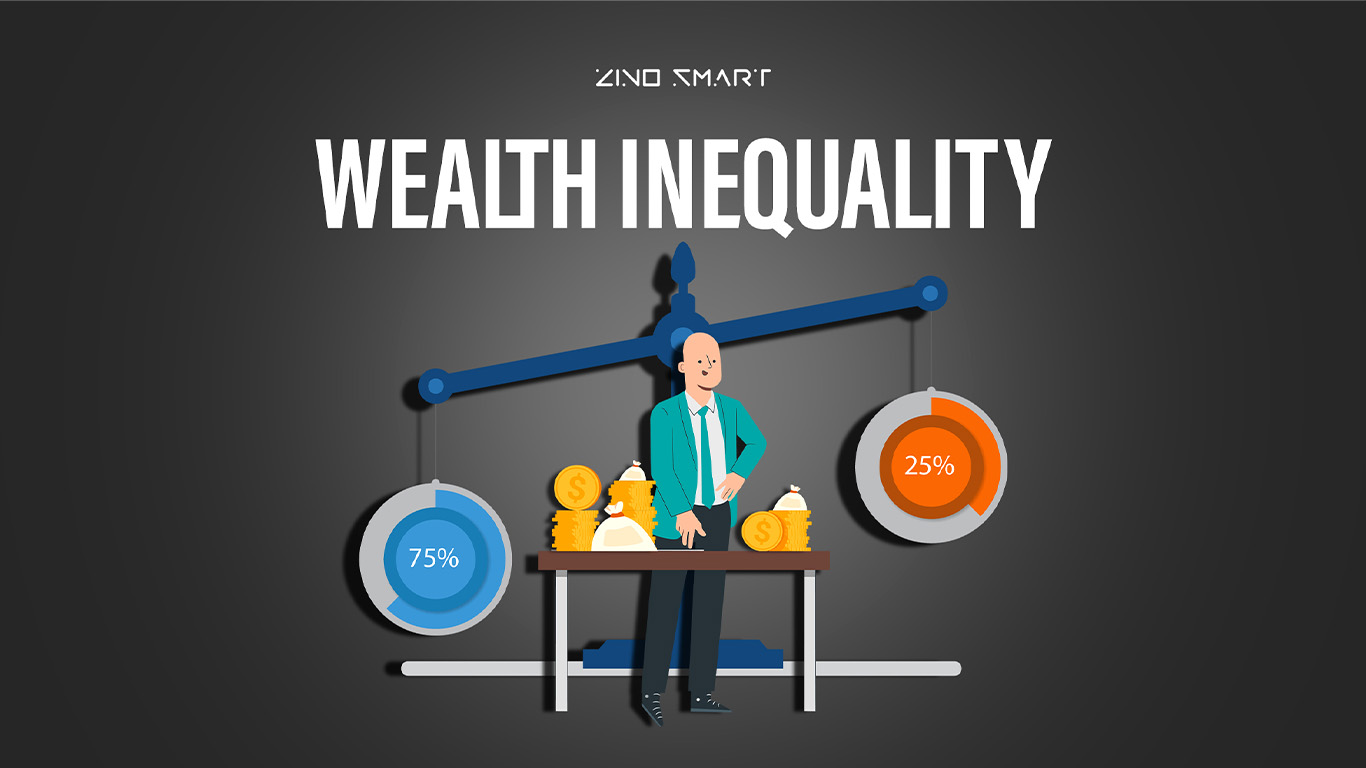

Wealth inequality is a concept that is crucial to understand to analyze the gap between the percentiles. The major question is, how can the gap be bridged?

earning

A large sum of your earning might be contributed to one big investment, which may be a home. When the market value drops, you’re essentially losing a lot of money, because your investment and risk are both highly concentrated in just one asset, with a low amount of diversification involved.

Diversification of income and assets is vital for the sustainability of your wealth, even if you belong in the 1% of the wealth percentile because you could lose the money just as you’ve accumulated all of it if you are not careful with what you do with that money.

Wealth Inequality

The wealthy don’t do anything special with their earnings, other than living frugally for some part of their lives as they save money in order to invest in assets. They don’t just invest in assets, but diversely spread out their investment in order to stay low on risk.

If one investment doesn’t work too well, they could just turn to another since they are still earning regardless of what happens with one investment.

investment

If all of your money is tied up in one investment as seen in the bottom 50% percentile, you’re essentially going to lose a lot of money if that investment is not fulfilling for you. This concentrates the risk in just one property and can cause a great prospect of a halt in the preservation of capital or returns for the future.

It can also be noticed that their consumer durables are more in number because of how those individuals might impulsively buy appliances that they think that they need, when in fact it might have been a want in the spur of the moment. It is common that the top 1% of wealthy people say no to most things merely because they believe that it is a want rather than a need and put it off for a while unless it’s absolutely necessary to be purchased, which is why the percentage of consumer durables is so low for them.

Portfolio

Portfolio diversification can be done in a few different ways – it can either be across different asset classes or diversification within an asset class — investments being spread across within the same asset class. It isn’t a surprise that real estate has become the fastest-growing and largest class in the world, considering that people from emerging countries actively seek homes and saving vehicles.

The income-generating capacity of the asset makes it an advantageous investment for people who are looking to save either for a more flexible retirement or for future generations. Even when it comes to the returns in the present, real estate doesn’t disappoint as it provides a steady flow of income if your real estate investment portfolio is well diversified over a period of time.