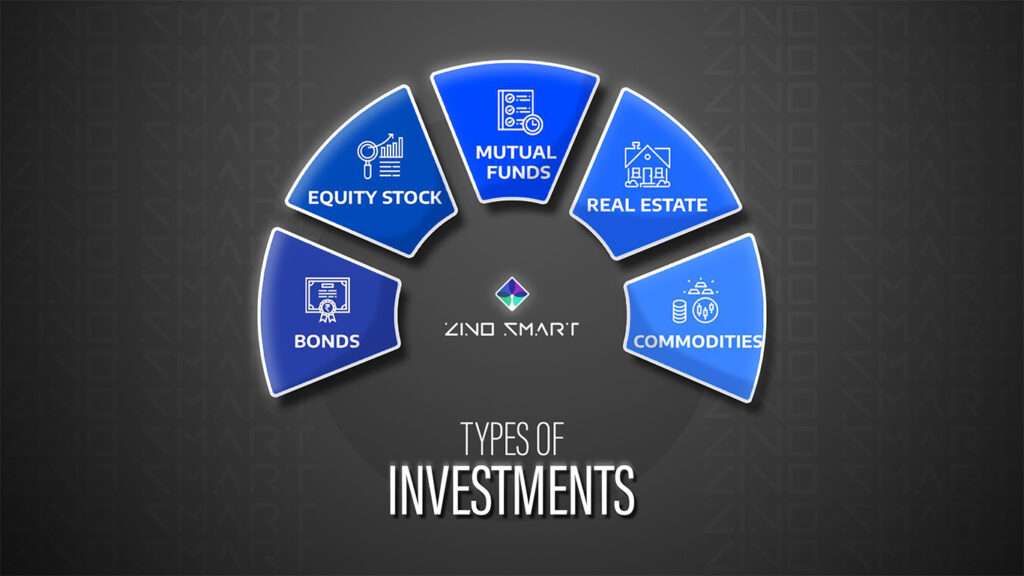

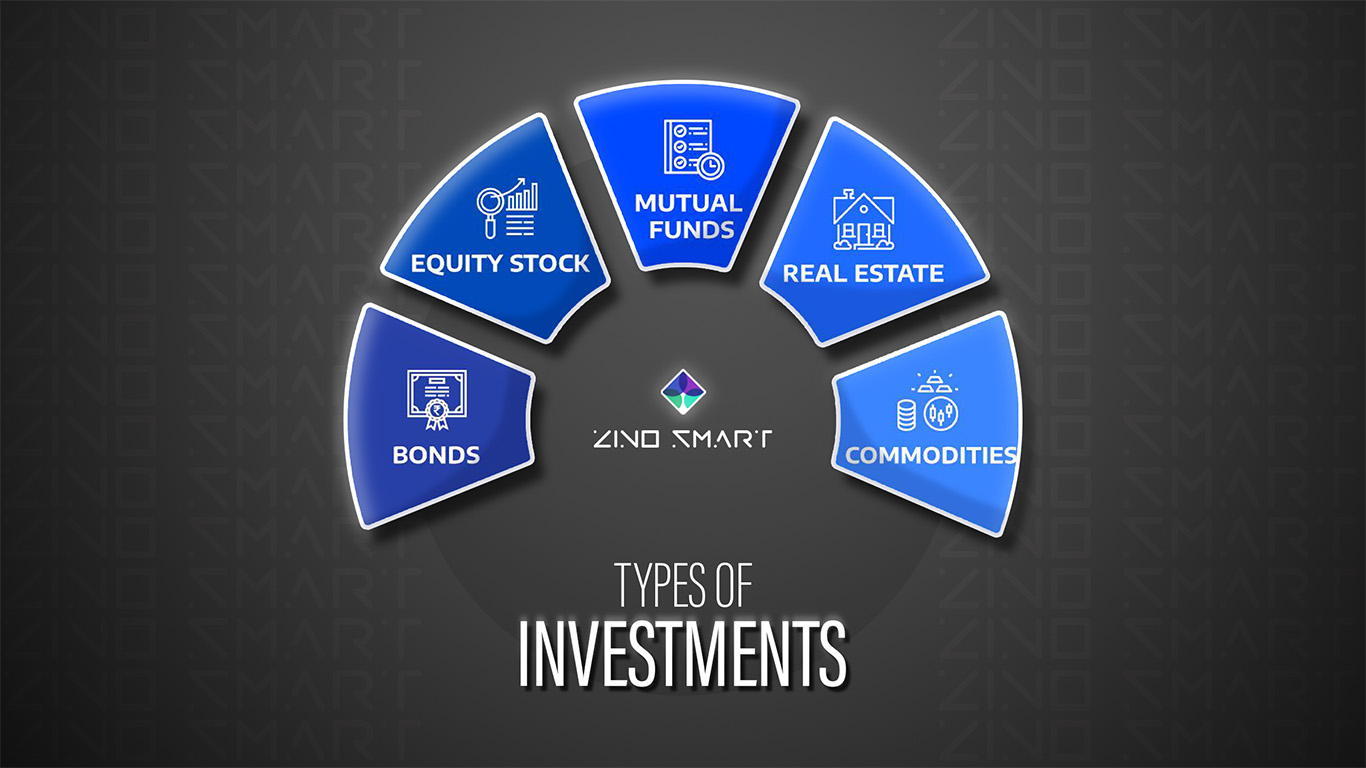

Types of Investments: There are arguably endless opportunities to invest. after all, upgrading the tires on your vehicle could be seen as an investment that enhances the usefulness and future value of the asset.Below are common types of investments that people use to appreciate their capital.

1-Stocks/Equities

A share of stock is a piece of ownership of a public or private company. By owning stock, the investor may be entitled to dividend distributions generated from the net profit of the company.

As the company becomes more successful and other investors seek to buy that company’s stock, its value can also appreciate and be sold for capital gains.

The two primary types of stocks to invest in our common stock and preferred stock. Common stock often includes voting rights and participation eligibility in certain matters.

2-Stocks

Preferred stock often has first claim to dividends and must be paid before common shareholders.

In addition, stocks are often classified as being either growth or value investments. Investments in growth stocks is the strategy of investing in a company while it is small and before it achieves market success.

Investment in value stocks is the strategy of investing in a more established company whose stock price may not appropriately value the company.

3-Bonds/Fixed-Income Securities

A bond is an investment that often demands an upfront investment, then pays a reoccurring amount over the life of the bond. Then, when the bond matures, the investor receives the capital invested into the bond back.

Similar to debt, bond investments are a mechanism for certain entities to raise money. Many government entities and companies issue bonds; then, investors can contribute capital to earn a yield.

4-coupon

The recurring payment awarded to bondholders is called a coupon payment. Because the coupon payment on a bond investment is usually fixed, the price of a bond will often fluctuate to change the bond’s yield. For example, a bond paying 5% will become cheaper to buy if there are market opportunities to earn 6%; by falling in price, the bond will naturally earn a higher yield.

5-Mutual Funds

Instead of selecting each individual company to invest in, index funds, mutual funds, and other types of funds often aggregate specific investments to craft one investment vehicle. For example, an investor can buy shares of a single mutual fund that holds ownership of small-cap, emerging market companies instead of having to research and select each company on its own.

Mutual funds are actively managed by a firm, while index funds are often passively-managed. This means that the investment professionals overseeing the mutual fund are trying to beat a specific benchmark, while index funds often attempt to simply copy or imitate a benchmark. For this reason, mutual funds may be a more expensive fund to invest in compared to more passive-style funds.

6-Real Estate

Real estate investments are often broadly defined as investments in physical, tangible spaces that can be utilized. Land can be built on, office buildings can be occupied, warehouses can store inventory, and residential properties can house families.

Real estate investments may encompass acquiring sites, developing sites for specific uses, or purchasing ready-to-occupy operating sites.

In some contexts, real estate may broadly encompass certain types of investments that may yield commodities. For example, an investor can invest in farmland; in addition to reaping the reward of land value appreciation, the investment earns a return based on the crop yield and operating income.

7-Commodities

Commodities are often raw materials such as agriculture, energy, or metals. Investors can choose to invest in actual tangible commodities (i.e. owning a bar of gold) or can choose alternative investment products that represent digital ownership (i.e. a gold ETF).

Commodities can be an investment because they are often used as inputs to society. Consider oil, gas, or other forms of energy. During periods of economic growth, companies often have greater energy needs to ship more products or manufacture additional goods.

In addition, consumers may have greater demand for energy due to travel. In this example, the price of commodities fluctuates and may yield a profit for an investor.

8-Cryptocurrency

Cryptocurrency is a blockchain-based currency used to transact or hold digital value. but Cryptocurrency companies can issue coins or tokens that may appreciate in value. These tokens can be used to transact with or pay fees to transact using specific networks.

In addition to capital appreciation, cryptocurrency can be staked on a blockchain. This means that when investors agree to lock their tokens on a network to help validate transactions, these investors will be rewarded with additional tokens.

In addition, cryptocurrency has given rise to decentralized finance, a digital branch of finance that enables users to loan, leverage, or alternatively utilize currency.

One reply on “Types of Investments”

[…] Investing […]