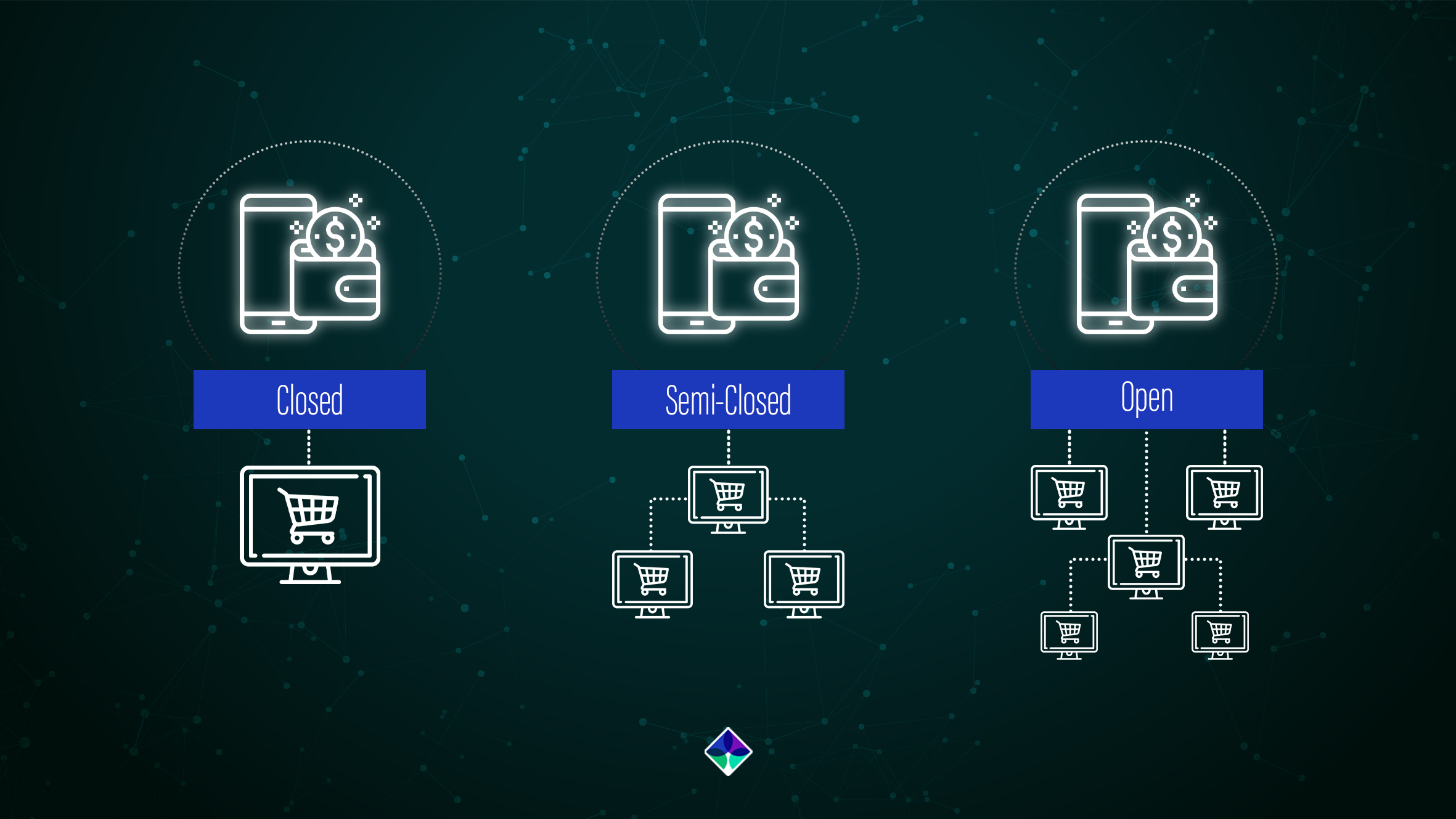

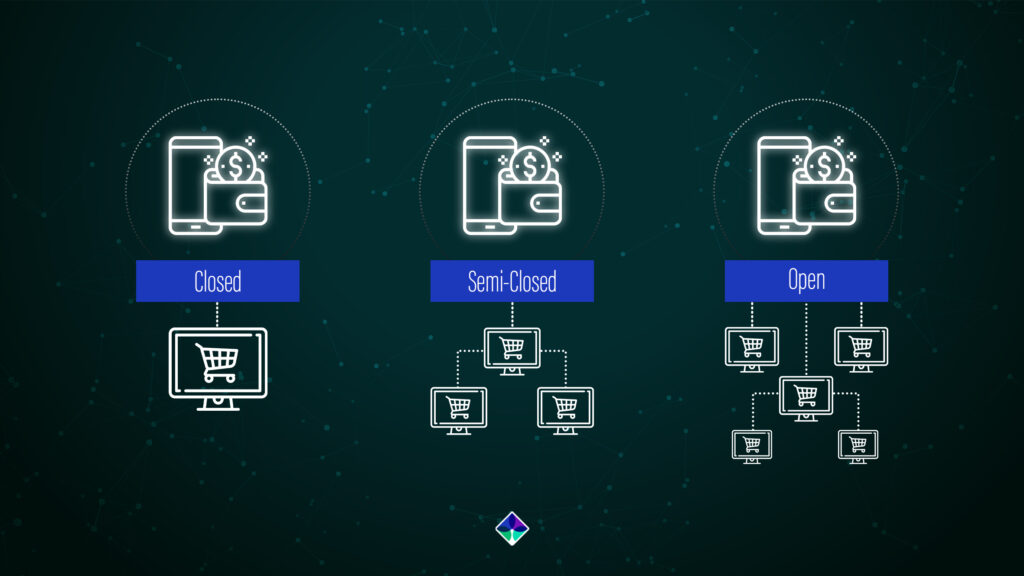

Types of digital wallets: There are three types of digital wallets — closed, semi-closed, and open.

Closed wallet

This wallet is restricted to certain individuals. For example, a company selling products and services can develop a closed wallet just for its customers. The money from returns and cancellations is stored in this wallet and users can only transact with the issuer of that wallet. Amazon Pay is an example of a closed wallet.

Semi-closed wallet

With a semi-closed wallet, users can make transactions at listed merchants and locations. The payment information is stored in a centralized location for safety purposes, but a user may need to share a key or a password with another person before making a transaction. A semi-closed wallet provides ease of use by storing multiple public addresses while keeping private keys offline.

Open wallet

Open wallets can be used to manage and track payment information online. Operating as easy-to-use online applications, a user can download an open wallet to any device or browser with an internet connection. Open wallets are compatible across all platforms and users can transact anytime and from anywhere.

Advantages of digital wallets

Streamlined customer experience. Digital wallets streamline and expedite the checkout process, as customers aren’t required to fill out lengthy checkout pages or forms.

This is a win-win for everyone, as faster checkouts discourage customers from abandoning their shopping carts, which in turn increases the conversion rates for businesses.

Security

Digital wallet providers, including Apple Pay and Google Wallet, use tokenization, which masks credit card details and is transaction-specific to prevent hackers from gaining access to consumers’ data. Digital wallets also employ biometrics, including fingerprint and facial recognition technology, which prevents the account information from being stolen.

For example, if a person drops a physical card or a wallet, their personal information can be easily stolen.

whereas digital wallets add layers of security through features such as Face ID or two-factor authentication, which makes it more difficult for anyone to access stolen information.

Contactless payments.

Contactless payments enable consumers to make payments without having to carry a card or search for one inside their physical wallets. Users can simply use touch or Face ID on their phones to confirm payment during the checkout process.

Valuable customer insights. Digital wallets help extract real-time data for valuable insights into a customer’s shopping habits, including their shopping history and preferences.

This helps businesses create targeted marketing campaigns as well as helps with inventory management and budget creation.

Access to rewards and offers. With digital wallets, consumers are often rewarded with special promotions and offers, such as cashback, coupons, and loyalty programs from their favorite brands and retailers.

Disadvantages of digital wallets

Digital wallets offer great convenience, but they also come with a few inherent risks. The following are a few disadvantages of using digital wallets:

Safety and privacy concerns. While digital wallets offer transaction security, there’s always a risk of getting hacked if the device gets lost or stolen. If hackers get access to a device with the digital wallet app, they could potentially get their hands on the device owner’s account and transaction history.

Limited merchants. Even with the wide acceptance of digital wallets among consumers, not all merchants — especially small shop owners — support it. This means people still need to carry cash and credit cards for certain transactions.

Security and budgeting.

Many people who are used to using cash and credit cards find it difficult to adopt contactless payment methods. Some might even believe that carrying physical money is safer or that paying cash might help them control their spending habits.

Device dependency. A digital wallet works on accessible devices only. This means that if a person misplaces their device or the device’s battery dies, they won’t have access to their digital wallet for payments.

Digital wallets are revolutionizing the customer experience by offering greater security, accessibility, and convenience. Here’s a look at the eight popular digital wallet companies and what they offer.